Reclaiming the Bitcoin P2P Vision for a Web5 Future

This paper is the collective work of the CKB Eco Fund, with much of the content inspired by discussions with Jan Xie, Cipher Wang, Han Tang, Baiyu, and Chester Chen. Corresponding author: Dr. Hongzhou Chen, Research Lead, hongzhou@ckbeco.fund . → Original Article

1. Introduction

In recent years, a sense of nihilism has pervaded the blockchain industry, as many feel it has deviated from the original vision of a “peer-to-peer version of electronic cash system” as laid out in the Bitcoin whitepaper [1]. Innovation has stagnated, with little real value creation or mass adoption. Instead, the space has been dominated by speculative gambling1.

At the root of this malaise is the Ethereum model, which has led the industry astray. Undoubtedly, Ethereum paved the way for a new era of programmable blockchains and prospered the whole industry in the past few years. However, today Ethereum went wrong. By attempting to turn blockchain into a general-purpose “world computer”, Ethereum has not only run into serious scalability challenges but has also created a proliferation of “decentralized in name only” (DINO) or pseudo-decentralized applications and platforms. This flawed approach has invited the recreation of the same rent-seeking middlemen and centralized chokepoints that blockchains were meant to disintermediate. However, all is not lost. By critically examining Ethereum’s missteps and rekindling the peer-to-peer (P2P) vision of Bitcoin, the industry can still get back on track. Correspondingly, this article argues the correct P2P vision will lead to a Web5 future, an integration of the best aspects of Web2 and Web3, with Bitcoin serving as its backbone (Web5 = Web2 + Web3).

Firstly, from a social-technical perspective, we analyze the three key aspects of Ethereum’s pseudo-decentralized model, participation, ownership, and distribution, and how they have produced perverse outcomes antithetical to the P2P vision of Bitcoin. Next, we will revisit Bitcoin’s architecture and how its design avoids or mitigates these issues. Then, we propose the “Common Lightning Initiative” as a roadmap toward realizing an actual P2P value network by building on Bitcoin’s foundations. Finally, we elaborate on our understanding of concepts like BTCFi, P2P economy, and Web5 with user cases.

The path ahead will not be easy. But by rediscovering Bitcoin’s roots (Proof-of-Work (PoW) + Unspent Transaction Output (UTXO)) and leveraging emerging technologies like Lightning Network, we can lay the foundation for Web5. Let us work together to reclaim the P2P vision and usher in the Web5 future of permissionless innovation and empowerment.

2. The Pitfalls of Ethereum’s Pseudo-Decentralization

2.1 Distinguishing Decentralization from Peer-to-Peer

Firstly, it’s important to acknowledge Ethereum’s significant contributions to the evolution of the blockchain industry. As the first platform to introduce smart contract functionality, Ethereum paved the way for a new era of programmable blockchains and decentralized applications (DApps). Its innovative Ethereum Virtual Machine and Solidity programming language enabled developers to build complex, Turing-complete smart contracts, opening up a world of possibilities beyond simple value transfer. Moreover, Ethereum’s initial coin offering (ICO) model, while controversial, democ- ratized fundraising and accelerated the growth of the blockchain ecosystem. These achievements cannot be overlooked when critiquing Ethereum’s current state. However, as critiques by Nick Szabo, the inventor of the smart contract concept, Ethereum, which once sounded so promising, has become a shitcoin as a result of devolving into a centralized cult2. What’s happened?

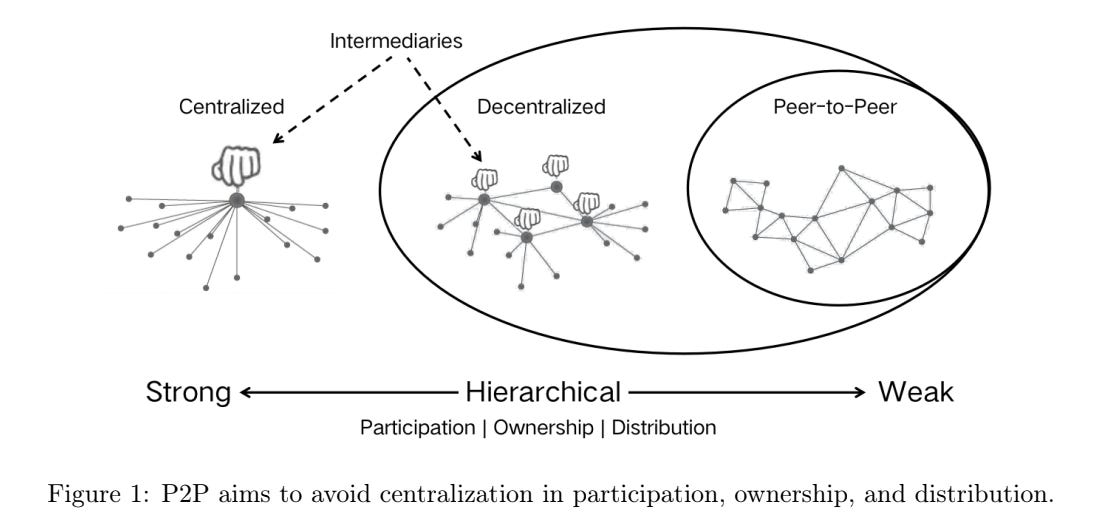

To understand where Ethereum went astray, it’s essential to distinguish between decentralization and peer-to-peer (P2P) architectures. While often used interchangeably, these terms differ significantly. Decentralized systems may still include hierarchies or intermediaries, whereas true P2P systems aim to eliminate them, fostering direct interactions between participants [2].

This distinction also has profound social and economic implications. Economists argue that hierarchy, the opposite of P2P, can lead to power concentration and the emergence of new intermediaries, who then extract rents, limit access, and shape system evolution [3], [4]. Hierarchy in socio-technical systems manifests in three key dimensions: participation, ownership, and distribution [5], [6]. True P2P systems minimize hierarchy across these dimensions, ensuring equitable access, control, and rewards.

Viewed in this light, the industry’s emphasis on “decentralization” aligns more closely with P2P principles rather than literally. Fig. 1 illustrates that a P2P system seeks to avoid centralization in participation, ownership, and distribution. However, Ethereum, while claiming to decentralize (we know it actually means to be P2P), has led to power concentration and new intermediaries across these dimensions, deviating from the P2P vision in Satoshi Nakamoto’s Bitcoin whitepaper. By analyzing pseudo-decentralization, we can identify where Ethereum diverged from the original P2P vision and how to realign with it.

2.2 The Pseudo-Decentralization of Participation: The Fallacy of “Everything On-Chain”

Ethereum paved the way for a new era of programmable assets and decentralized applications, attracting developers and users alike. However, Ethereum’s pursuit of becoming a “world computer,” which has followed the larger block principle extremely, led to a concerning centralization trend [7].

The “everything on-chain” mindset has overburdened Ethereum’s base layer, leading to network congestion, slower transactions, and higher fees. This has forced a shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS), not only compromised in security for ledgers maintaining but also concentrating power among a few large stakeholders [8]. The rise of staking models has exacerbated centralization, with projects introducing PoS mechanisms into Bitcoin, proving catastrophic. Moreover, more doubtful attempts to use Bitcoin’s security to provide guarantees for PoS-based blockchains, rather than enhancing the security of Bitcoin, undermine the decentralization principles and raise concerns about their effectiveness.

The attempt to turn blockchains into “world computers” is misguided. Blockchain enhances societal circulation rather than creating it, serving as a technical advance in production relations rather than productivity [9]. Even Vitalik admits that blockchains are inefficient at computation and storage, trading performance for censorship resistance and trustless consensus [10]. Ironically, by moving everything on-chain, Ethereum has fallen into a trap it recognized. Blockchains should focus on their socio-technical mission: providing a neutral, censorship-resistant settlement layer, rather than attempting to be everything. Most computation and data storage should be off-chain, with only critical state updates on-chain.

2.3 The Pseudo-Decentralization of Ownership: The Pitfalls of Blockchain as a “Middleman”

In the 1970s, Chile’s Project Cybersyn sought to manage the economy via centralized computer control, but it failed due to elitism and centralization [11]. Ethereum’s development parallels this, where its account-based model and smart contract-centric design have birthed a new technocratic elite, particularly among L2 solution providers and core developers within the Ethereum Foundation (EF). These groups control essential infrastructure, extract economic rent, and gradually concentrate power and wealth [12]. The account model abstracts and obscures true asset ownership, creating a veneer of decentralization while actual control remains with a small cadre of developers who write and maintain smart contracts. Furthermore, the revolving door between the EF and prominent L2 projects, such as the “re-staking” of EF researchers into projects like EigenLayer, exacerbates conflicts of interest and entrenches a culture of patronage where projects endorsed by Vitalik and the EF are deemed legitimate while others are marginalized [13].

From a technical perspective, Ethereum’s account model and stateful design contribute to this centralization. The account model tightly integrates asset ownership with application-layer logic, transforming peer-to-peer interactions into peer-to-contract relationships [14]. This global state model not only introduces a central point of control but also leads to rapid state growth as the number of transactions and smart contracts increases, centralizing power further. This centralization is further evidenced in extracting MEV (Maximal Extractable Value) by L2 solutions. Originally viewed as an attack vector, MEV extraction has been legitimized through the “democratically” distribution among key stakeholders, leading Ethereum to increasingly resemble traditional financial systems3. Additionally, most current Ethereum L2 solutions rely on multi-signature wallets or committee-authorized upgradeable contracts, introducing centralized risks [15]. The rise of corporate-led chains like Soneium is a stark warning of the potential future where decentralization is reduced to a mere façade, masking the concentration of power in the hands of a few.

To avoid this dystopian future, it is imperative to move beyond Ethereum’s flawed model. Returning to the original P2P vision, emphasizing individual sovereignty over centralized intermediaries offers a path toward a more open and equitable system.

2.4 The Pseudo-Decentralization of Distribution: Speculation-Driven Token Economies

Ethereum’s 2015 launch initiated a wave of ICOs, enabling projects to issue tokens as a means of democratizing fundraising and distributing value. While this promised broader participation in new ventures, it also led to an influx of “shitcoins” with minimal utility and value [16]. The token-oriented business model blurred the line between speculative investment and genuine value creation. Many ICOs were little more than get-rich-quick schemes. Even legitimate projects faced distorted incentives, as projects are judged more on their token price performance than on actual adoption or impact.

The centralized control over token minting and distribution by project teams further undermines decentralization. As scholar Angela Walch notes, this creates significant information asymmetry, giving insiders an advantage over ordinary users [17]. The concentration of tokens among early investors leads to wealth inequality and centralization of governance power, with Ethereum’s value proposition being criticized as a “Veil of Decentralization,” [18], and similar to the hierarchies and intermediaries we discussed earlier.

However, rather than dismissing ICOs outright, it’s important to recognize that they marked a significant shift in the cryptocurrency space, transitioning from traditional equity financing to token economies. ICOs provided crucial seed funding for developing decentralized protocols and applications, opening investment opportunities to a broader audience [19]. The issue lies in the misuse of ICOs, where tokens were forcibly embedded into business models, creating speculative bubbles and misaligned incentives. For tokens to have real value, the industry must shift from a token-centric to a service-centric model. Stablecoins are key to this transition. Stablecoins act as a bridge between the traditional financial system and the crypto economy, providing a stable medium of exchange that supports cooperation and economic specialization [20], [21]. This reflects a broader historical shift from focusing on asset price appreciation to prioritizing utility and user experience. We believe that Bitcoin-native stablecoins will take this a step further and enable an innovative P2P economy.

3. Returning to Bitcoin: The True Path of the P2P Paradigm

To realign with the original P2P vision and address the shortcomings of the Ethereum model, we must return to Bitcoin’s roots and build upon its robust technical stack. Bitcoin’s unique combination of PoW consensus, programmable UTXO model, Lightning Network, and native stablecoins offers a powerful foundation for realizing the true potential of cryptocurrencies and blockchain-based systems. By leveraging these key components, we can create a more open, secure, and scalable ecosystem that empowers users and enables genuine P2P interactions.

3.1 Empowering Participation: PoW and the Programmable UTXO Model

One of the key advantages of Bitcoin’s technology stack is its ability to enable true decentralization (actually, we should call it P2P) that empowers users to participate in the network on equal footing. This is achieved through a combination of PoW consensus and the programmable UTXO model.

PoW consensus is not only the most secure but also the most economically efficient mechanism for achieving distributed consensus in a decentralized network, which is even counter-intuitively the cheapest way to implement a 51% attack-resistant protocol [22]. Unlike PoS systems, which suffer from a range of issues such as “nothing-at-stake” attacks, long-range attacks, and centralization of stake, PoW ensures that the cost of attacking the network is directly proportional to the amount of computational power an attacker must acquire. Comparatively, PoS has a circular logical loophole where the largest holders determine the ledger state, and the ledger state determines who the largest holders are. Moreover, cooperation is fundamentally based on trust, which requires participation and commitment through labor. Participation is not only about being involved or having a say but also about having skin in the game and contributing real value [23], [24]. PoW consensus is not just a technical mechanism but a social contract that aligns participants’ incentives with the network’s security and stability. This is the social science perspective that explains why PoW is so powerful. It ensures that participants have a tangible stake in the system and are incentivized to act in its best interests. PoW ensures that participation in the network is open to anyone willing to contribute computing power and energy to secure the blockchain in a fair dimension (the time, of course, the essence of energy is also the time), enabling a more decentralized and democratic form of participation. This aligns with the fundamental principles of P2P systems, which aim to minimize reliance on trusted intermediaries and enable direct interactions between participants.

Regarding programmability, the UTXO model offers a unique approach to building certain types of applications and services on top of the base layer. Unlike Ethereum’s account-based model, which maintains a global state and requires all nodes to process all transactions, the UTXO model treats each transaction output as a discrete, “first-class” asset [25]. While this model may be less flexible for complex smart contracts, it enables a more scalable and privacy-preserving approach to transaction validation, as nodes only need to validate the specific UTXOs they are interested in rather than the entire global state. Furthermore, the concept of “first-class” assets empowers users with greater control and ownership over their digital assets, just like cash or coins. In the UTXO model, users have direct custody of their assets, as each UTXO is controlled by a specific set of private keys. This is in contrast to account-based models, where assets are often held in contracts controlled by third parties, similar to the traditional bank. By enabling users to directly own and control their assets, the UTXO model promotes a more decentralized and user-centric approach to digital asset management. To leverage the full potential of the programmable UTXO model, new protocols such as RGB++ Layer [26] are being developed to extend Bitcoin’s capabilities without compromising its base layer security. RGB++ introduces the concept of “isomorphic binding,” which allows smart contracts to be executed off-chain while still being anchored to the Bitcoin base layer through UTXOs. This enables more complex computations and data storage without burdening the base layer, promoting greater scalability and flexibility [27].

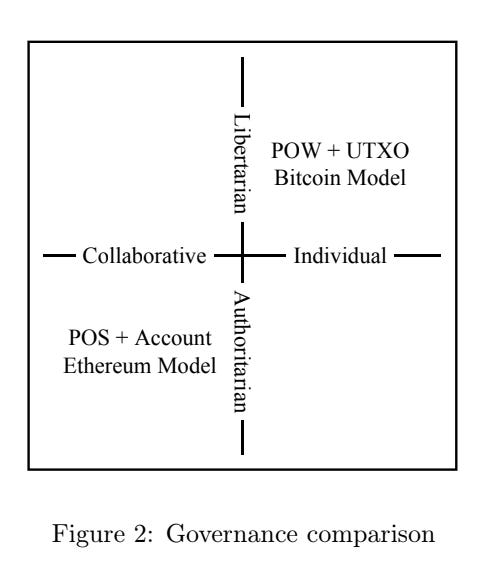

Combining PoW and the programmable UTXO model also enables a unique form of governance that emphasizes individual liberal competition. Firstly, under PoW, miners compete for rewards through individual efforts. This is unlike PoS, which needs a cooperative collective agency to conduct the voting or staking. Secondly, since each UTXO is a discrete asset, users can freely transact and interact with each other without needing permission from a central authority. In contrast, the account model manages assets in a centralized manner, resembling authoritarianism, with a few large stakeholders influencing the direction of the network. Therefore, as Fig. 2 shows, we can put the POW + UTXO and POS + Ac- count into the political compass. PoW + UTXO falls into the Libertarian-individual quadrant. Pos + Account falls into the Authoritarian-Collective quadrant. The stark contrast between these two approaches highlights the fundamental differences in their underlying philosophies and the types of systems they enable. The PoW + UTXO combination aligns with the P2P vision of Bitcoin, promoting individual freedom, decentralization, and direct interaction between participants, the PoS + Account model represents a significant departure from these principles. By understanding the political and philosophical underpinnings of different blockchain designs, we can make more informed decisions about the systems we build and participate in, ensuring that we remain true to the transformative potential of the P2P paradigm.

3.2 Eliminating Intermediaries: The Lightning Network

Bitcoin’s base layer provides a secure, decentralized foundation for storing and transferring value. However, it faces limitations in terms of scalability and transaction speed. To address these challenges and enable true P2P interactions without relying on intermediaries, the Bitcoin community introduced the Lightning Network, a second-layer solution that operates on top of the Bitcoin blockchain [28]. The Lightning Network enables instant, low-cost, and scalable micropayments while maintaining the core principles of decentralization and security. By leveraging off-chain payment channels and smart contracts, users can transact directly without broadcasting every transaction to the main chain. This approach significantly reduces the load on the Bitcoin network, allowing for faster, cheaper, and private transactions suitable for various use cases to eliminate intermediaries.

The Lightning Network’s design aligns perfectly with the concept of a P2P electronic cash system. By enabling direct, bilateral payment channels between users, the Lightning Network eliminates the need for intermediaries at the most fundamental level of blockchain-based transactions, the transfer of value, which is a crucial step towards achieving true P2P social-technical systems. To truly achieve the vision of a P2P system, a solution must exhibit four key characteristics: high throughput, low latency, low cost, and privacy. The Lightning Network excels in all four aspects, making it the most viable path towards realizing the potential of crypto-based payments. In contrast, while Ethereum’s L2 solutions aim to improve scalability and reduce transaction costs, they even introduce new intermediaries, as discussed in Section 2.3. Moreover, the multi-node consensus inherent in blockchain-based systems makes them inherently more expensive and slower compared to fully centralized systems, particularly in payment scenarios. When considering the global population of 8 billion people, Ethereum models are unlikely to replace traditional payment systems like VISA due to their inherent limitations in scalability and transaction costs.

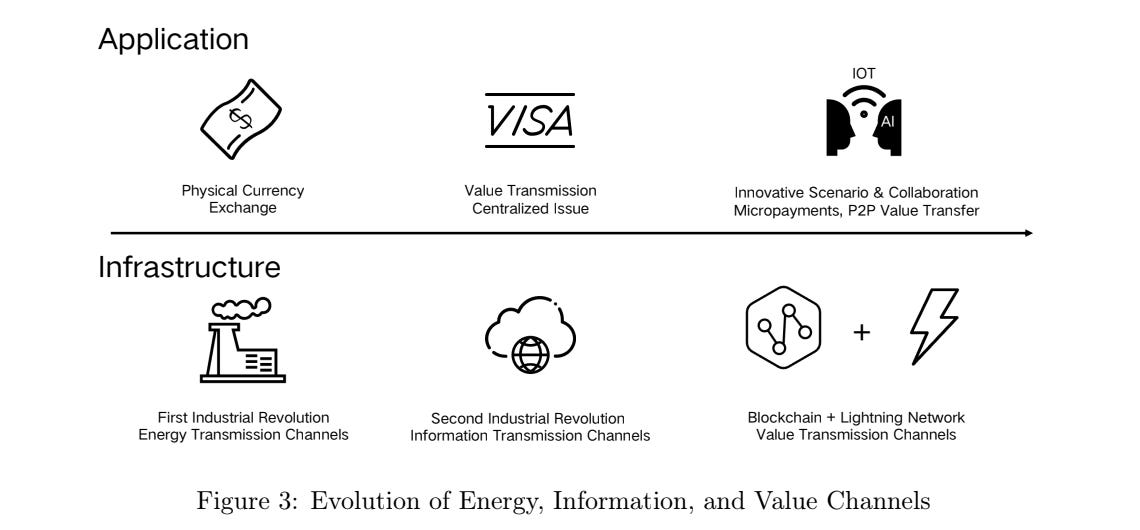

The First Industrial Revolution established global channels for energy transmission, and the Second established channels for information transmission. However, we still lack a dedicated channel for value transmission. Existing value-transfer methods, such as VISA systems, operate at the application layer, built upon the information channel without a fundamental value-transfer infrastructure. Blockchain has the potential to serve as this missing value channel, but it alone is insufficient. To truly revolutionize value transfer, we need a combination of blockchain and the Lightning Network. In this value network, the blockchain handles large-value transactions, while the Lightning Network facilitates small-value, high-frequency transactions. Just as the information channel has been extended globally, the value channel should be built in parallel, reaching wherever the information channel reaches.

As shown in Fig. 3, introducing a dedicated value channel alongside the existing energy and information channels represents a significant leap forward. This innovation in payment methods is essentially a revolution in production relations, with the potential to transform business models and collaboration. Just as using seashells could not give rise to a modern financial system, the Lightning Network’s fundamental impact lies in its ability to change pricing models and expand the realm of imagination. Many scenarios, difficulty relying on subjective human judgment for pricing, can now be transformed into more atomized, granular pricing mechanisms. This shift is particularly relevant in the context of the Internet of Things (IoT) and Artificial Intelligence (AI) applications, where the Lightning Network’s micro-transaction capabilities can enable new forms of machine-to-machine interactions and data monetization [29].

Another key advantage of the Lightning Network is its ability to provide privacy for transactions. In a world where traditional payment systems have become a “digital panopticon” [30], exposing users’ financial activities to surveillance and potential misuse, the Lightning Network’s off-chain payment channels allow for private transactions that are not broadcast to the public blockchain. This privacy feature is crucial for many real-world payment scenarios, as businesses and individuals often require confidentiality in their financial transactions. While privacy-focused cryptocurrencies like Zcash and Monero have attempted to address the privacy issue, they have often been associated with illicit activities [31]. In contrast, the Lightning Network’s privacy features are built on top of payment channels, allowing users to benefit from enhanced privacy without the stigma or risk associated with specific privacy coins. Moreover, the Lightning Network has the potential to promote financial inclusion and bridge the digital divide in access to financial services. All these eliminating of intermediaries could have significant implications for remittances, e-commerce, and access to digital goods and services in emerging economies.

3.3 From Token-Oriented to Service-Oriented: Bitcoin-Native Stablecoins

RAND Corporation points out that Bitcoin and stablecoins are sufficient to support the massive adoption of cryptocurrencies and drive the industry forward [32], [33]. Although it’s somehow subjective, this combination is crucial to overcoming the financial speculation and realigning the industry with the original P2P vision.

As we know, one of the greatest challenges for Bitcoin to succeed as a common medium of exchange is its volatility. This is where stablecoins come in. By providing a price-stable asset pegged to a reference like the Fiat, stablecoins can serve as a bridge between the traditional financial system and the crypto economy [20]. Stablecoins, like their Fiat counterparts, provide a stable medium of exchange, which is the fundamental of cooperation, specialization, and organization in human history [21]. During this historical development, we shifted our focus from asset price appreciation to actual utility and experience, incubating the modern economy system underlying paradigm: using stable medium to exchange others’ services [34], [35].

The history of stablecoins has been marked by the development of various types, each with its unique characteristics and challenges. Tether (USDT) and USD Coin (USDC) have gained significant traction but have faced criticism over transparency and centralization issues. In contrast, decentralized stablecoins, such as MakerDAO’s DAI, once had been considered a promising alternative. However, most existing decentralized stablecoins are built on the Ethereum network, which suffers from pseudo-decentralization issues, as discussed earlier. Especially, MakerDAO’s recent rebranding and introduction of account freezing functionality further highlight the need for a truly decentralized, censorship-resistant stablecoin solution.

To realize the potential of stablecoins in enabling a service-oriented, P2P economy [36], we need Bitcoin-native stablecoins that align with the core principles of the Bitcoin network. These stablecoins, like Stable++ (RUSD), could be built on the RGB++ Layer and leverage the security and decentralization of Bitcoin while providing a stable medium of exchange and unit of account. By eliminating the need for centralized platforms or authorities to manage the issuance, redemption, and account freezing, Bitcoin-native stablecoins promote a more inclusive and censorship-resistant ecosystem. It’s worth noting that within the Bitcoin ecosystem, there is room for both decentralized and centralized stablecoin solutions. While decentralized stablecoins like RUSD offer greater censorship resistance and align more closely with Bitcoin’s ethos, centralized options may provide enhanced convenience and liquidity. The coexistence of these diverse solutions reflects the vibrant and competitive nature of the Bitcoin community, where multiple approaches can flourish and cater to different user preferences, whether they prioritize privacy or ease of use. As these various stablecoin solutions compete and evolve, users will be empowered to choose the option that best suits their needs, ultimately leading to a more robust and user-centric ecosystem.

Moreover, integrating Bitcoin-native stablecoins with the Lightning Network will unlock a powerful synergy that enables a wide array of P2P financial services and applications. The Lightning Network’s instant, low-cost, and scalable micropayments, combined with the stability of Bitcoin-native stablecoins, create an ideal environment for everyday transactions, remittances, and complex financial products. This combination could eliminate the need for entrepreneurs to issue tokens and face the risks associated with potential security violations, allowing them to focus on building valuable services and user experiences.

In short, from the distribution perspective, the success of Bitcoin-native stablecoins and the Lightning Network will have broader implications for power distribution and control within the cryptocurrency industry. By providing a stable and accessible foundation for P2P transactions, this approach empowers individuals and businesses to interact directly without relying on centralized intermediaries. This shift towards a more service-oriented model aligns with the original P2P vision, promoting greater financial inclusion, innovation, and value creation.

3.4 Summary

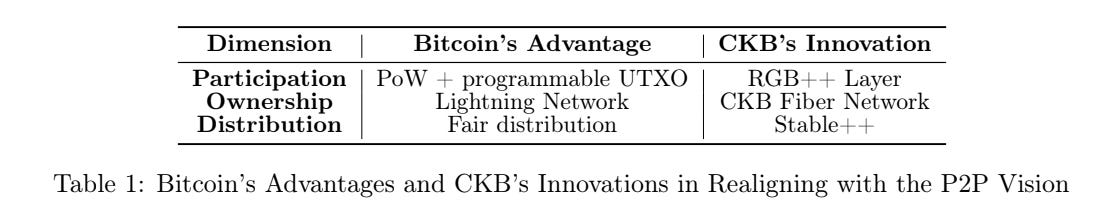

Throughout this section, we have explored how Bitcoin’s technology stack, including the PoW, programmable UTXO model, Lightning Network, and Bitcoin-native stablecoins, provides a robust foundation for realizing the true potential of cryptocurrencies and blockchain-based systems. By examining these components, we have demonstrated how they address the shortcomings of Ethereum’s pseudo-decentralized model across the dimensions of participation, ownership, and distribution. Table 1 summarizes how Bitcoin’s core technologies, along with CKB’s innovations, contribute to realigning the blockchain industry with the original P2P vision.

The progress of society hinges on reducing cognitive costs, increasing the value of information flow, minimizing vulnerabilities, and discovering new mutually beneficial participants. The foundation of this process is trust minimization [37]. As human society has evolved, this minimization of trust has undergone a series of transitions, from kinship and ethnicity to legal systems. However, even the widely recognized legal frameworks of today remain fragile and difficult to apply universally on a global scale.

This is where the socio-technical mission of blockchain technology comes into play. The ultimate goal of blockchain is to enable true P2P interactions, allowing two individuals without any other supporting trust mechanisms to establish secure and efficient transactions. However, Ethereum’s pursuit of becoming a world computer has somewhat deviated from this original vision. Ethereum’s

emphasis on on-chain computation and smart contracts has come at the expense of decentralization and social scalability. In contrast, Bitcoin’s technology stack was designed from the outset to focus on trust minimization within a P2P scene. Admittedly, Bitcoin faced challenges, such as slow confirmation times, limited programmability, and high price volatility, etc. However, as technology continues to develop and mature, these issues are gradually being addressed. Innovative projects like Nervos CKB are further optimizing and expanding upon the Bitcoin model. The Bitcoin ecosystem is progressing towards greater social scalability and the realization of the P2P vision.

4. Reclaiming P2P Vision for a Web5 Future: The Initiative, Trinity Pizza, Use Cases, and Web5

4.1 The Common Lightning Initiative

The Common Lightning Initiative is an ambitious plan to realign the blockchain industry with Satoshi Nakamoto’s original vision of a peer-to-peer electronic cash system. Bitcoin has demonstrated that a blockchain network built on P2P mining nodes can be a solid foundation for achieving consensus on digital gold. The decentralized nature of the Bitcoin network, enabled by its globally distributed mining nodes, ensures the security, immutability, and censorship resistance of the blockchain. Regarding the Lighting Network, numerous widely distributed nodes are also vital for its security, capacity, and resilience.

However, the current Bitcoin Lightning Network has only around 15,000 nodes and has seen limited growth since 20224. The insufficient infrastructure limits its capacity to around 5,000 BTC5 together with few assets supporting it, which is incapable of superseding the traditional financial system globally. Therefore, based on our Fiber Network, we propose combining the Lighting Network with the Depin hardware infrastructure. By producing dedicated Lightning Network nodes using Depin hardware, we can create a robust and geographically distributed infrastructure that can support the growing adoption and usage of the Lightning Network.

The term “Common” in the initiative represents a more inclusive Lightning Network, fostering participation across two key dimensions: cross-chain compatibility and diverse implementations. Firstly, the initiative aims to extend the Lightning Network beyond Bitcoin, encouraging other blockchains to develop their own implementations. For instance, CKB introduced the Fiber Network (CFN), Liquid has the Lightning Channel, and Cardano is developing Hydra, both of which were inspired by the payment channel approach. Secondly, the initiative emphasizes interoperability between different implementations. The CFN, for example, is designed to be compatible with the Bitcoin Lightning Network, allowing seamless cross-network transactions. The goal is to create a global, interconnected network of Lightning Networks, where Bitcoin’s Lightning Network is one of many subnetworks. By promoting interoperability, the initiative envisions a highly liquid, global value network that facilitates the seamless transfer of assets across various channels.

The Common Lightning Initiative consists of three key components:

Full development of CFN: CFN is a high-performance, multi-asset lightning network that aims to enhance the scalability, interoperability, and user experience of the existing Lightning Network. CFN will support multiple assets, including BTC, stablecoins, and RGB++ assets, enabling seamless cross-chain swaps and multi-asset transactions within a single payment channel. CFN will also implement advanced features such as channel factories, watchtowers, and multi-path payments to improve the network’s efficiency, security, and reliability. In short, CFN is the Lightning channel on CKB.

Integration with Depin hardware: To ensure the decentralization and robustness of the Lightning Network, we will integrate CFN with the Depin hardware ecosystem. By significantly increasing nodes by Depin hardware, we expect to create a globally distributed and censorship-resistant network that can support the growing demand for fast and low-cost payments. Moreover, by leveraging the security and reliability of Depin hardware, we can provide Bitcoin-native yield opportunities for end-users who contribute their BTC, stablecoins, or RGB++ assets to the network’s liquidity pools.

Cultivation of a P2P application ecosystem: The ultimate goal of the Common Lightning Initiative is to foster the development of a thriving P2P application ecosystem that leverages the Lightning Network and Depin hardware. By providing a fast, low-cost, and scalable payment infrastructure, we aim to enable a wide range of innovative applications and services that can reshape traditional business models and create new opportunities for value creation and exchange. This might include Lightning Network-based DEXs, microtransaction-based content platforms, and more. We will actively support and incentivize developers and entrepreneurs to build on top of the CFN and Depin infrastructure, creating a vibrant and self-sustaining P2P ecosystem that drives the adoption and growth of the Lightning Network.

By focusing on these critical aspects, the Common Lightning Initiative seeks to establish a solid foundation for a thriving P2P economy, one that empowers individuals and businesses to transact directly, securely, and efficiently without relying on centralized intermediaries.

4.2 Completing the Trinity Pizza

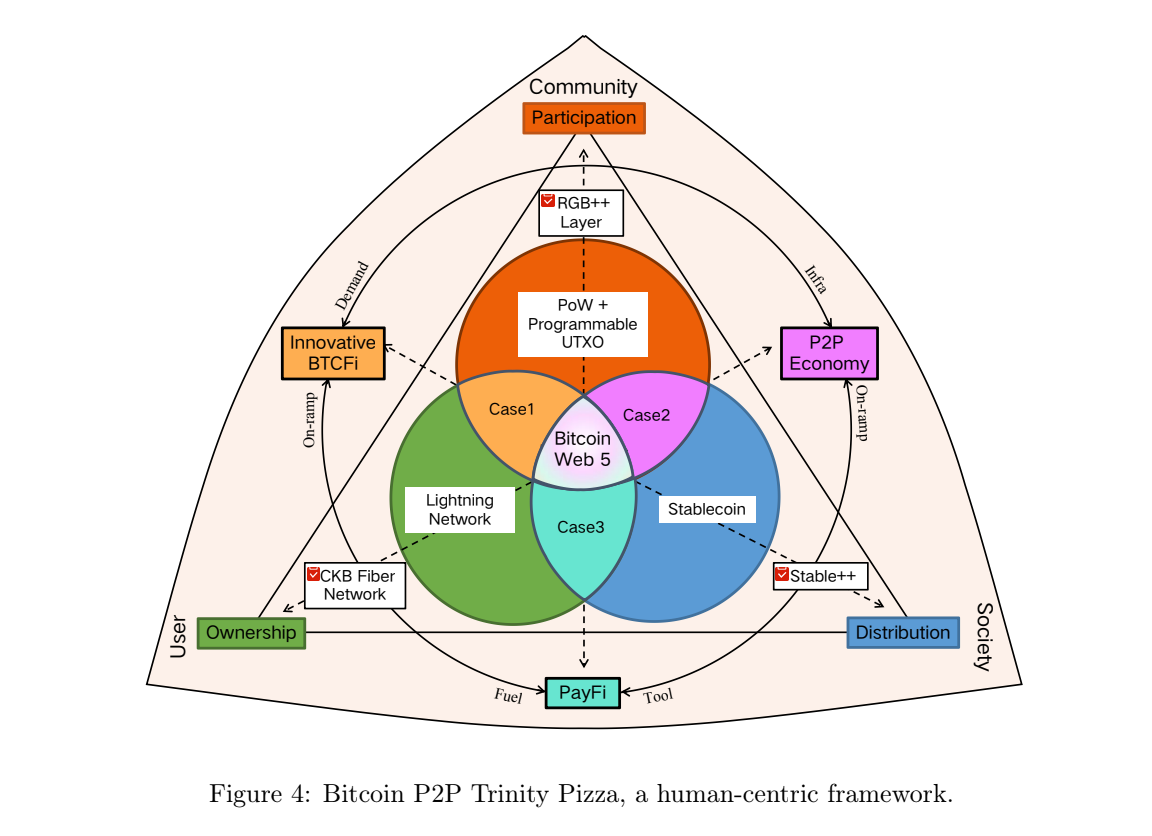

Notably, the Common Lightning Initiative is not just an isolated project. It is the final piece of a comprehensive, interconnected trinity that aims to address the core issues plaguing the blockchain industry and realign it with the original P2P vision of Bitcoin. This trinity comprises three key components, each addressing a specific dimension of the industry’s challenges: participation, ownership, and distribution. As Fig. 4 shows, at the heart is a Pizza (Yes, the Venn diagram looks like a Pizza), with three overlapping circles representing the critical elements of the solution. The first circle, PoW + Programmable UTXO, tackles the issue of participation. The second circle represents stablecoins as the primary solution addressing the distribution problem. The third circle symbolizes the Lightning Network, the key innovation solving the ownership issue.

The intersection of the PoW + Programmable UTXO and Lightning Network circles forms the foundation for BTCFi. BTCFi unlocks a wide range of decentralized financial applications and services, driving innovation and value creation within the Bitcoin ecosystem. Where the PoW + Programmable UTXO circle meets the stablecoins circle, a new Bitcoin-supported P2P Economy [36] emerges, driving the industry to the service-orientation. The intersection of the stablecoins and Lightning Network circles gives rise to PayFi, a Bitcoin-native, P2P payment infrastructure. Th PayFi harnesses the stability of stablecoins and the efficiency of Lightning Networks to facilitate seamless, low-cost, and secure P2P transactions, empowering users to engage in direct economic interactions without relying on traditional financial intermediaries. These intersections are mutually reinforcing, creating a virtuous cycle of growth and adoption. BTCFi provides the financial infrastructure and tools necessary to support the development of the P2P Economy, while the P2P Economy creates demand for BTCFi services and fuels the growth of PayFi. In turn, PayFi serves as a critical on-ramp for users to access BTCFi and participate in the P2P Economy, driving further adoption and network effects.

Notably, from the description, it can be seen that in our framework, humans (users, communities, societies) are always the first consideration, underlying all the components and processes. In other words, Bitcoin’s P2P “Bazaar” [38] can accommodate diverse voices and ideas, demonstrating the infinite power of the community. This fundamentally differs from the Ethereum model, which cores around smart contracts, with humans merely being appendages.

4.3 Web5 = Web2 + Web3

At the center of this trinity, where all three circles converge, lies the ultimate goal: realizing Bitcoin’s P2P vision and ushering in a new era of Web5, a paradigm that combines the best aspects of Web2 and Web3. Web5, built on the solid foundation of Bitcoin, represents a P2P future where users can interact, transact, and create value freely and directly without the constraints of centralized platforms or intermediaries. Although the term “Web5” was initially proposed by Jack Dorsey [39], our understanding and vision of Web5 go beyond his definition. While Dorsey’s proposal might have been bantering, we take the concept of Web5 seriously, as it aligns perfectly with our vision for the future of the internet.

For a long time, we struggled to find a term that accurately represents the ecosystem we are building, which is fundamentally different from Ethereum’s approach. Before Dorsey introduced Web5, we lacked a suitable term to express our goal of creating a decentralized future distinct from the prevailing Web3 narrative. The emergence of Web5 provided a fitting description of our vision. The equation “Web5 = Web2 + Web3” succinctly encapsulates our belief that the future lies not in moving everything onto the blockchain but in combining the best elements of Web2 and Web3. Moreover, there are numerous ways to achieve this integration. For instance, account abstraction (AA) and passkey can be employed, while Nostr represents another approach to bridging Web2 and Web3. Considering a spectrum with P2P on one end and centralization on the other, these solutions occupy the middle ground. Lastly, the term “Web5” is not only meaningful but also engaging and thought-provoking. At first glance, it might appear to be a lighthearted joke. However, upon further reflection, the concept reveals its profound implications and potential. This makes “Web5” an ideal rallying slogan for our vision.

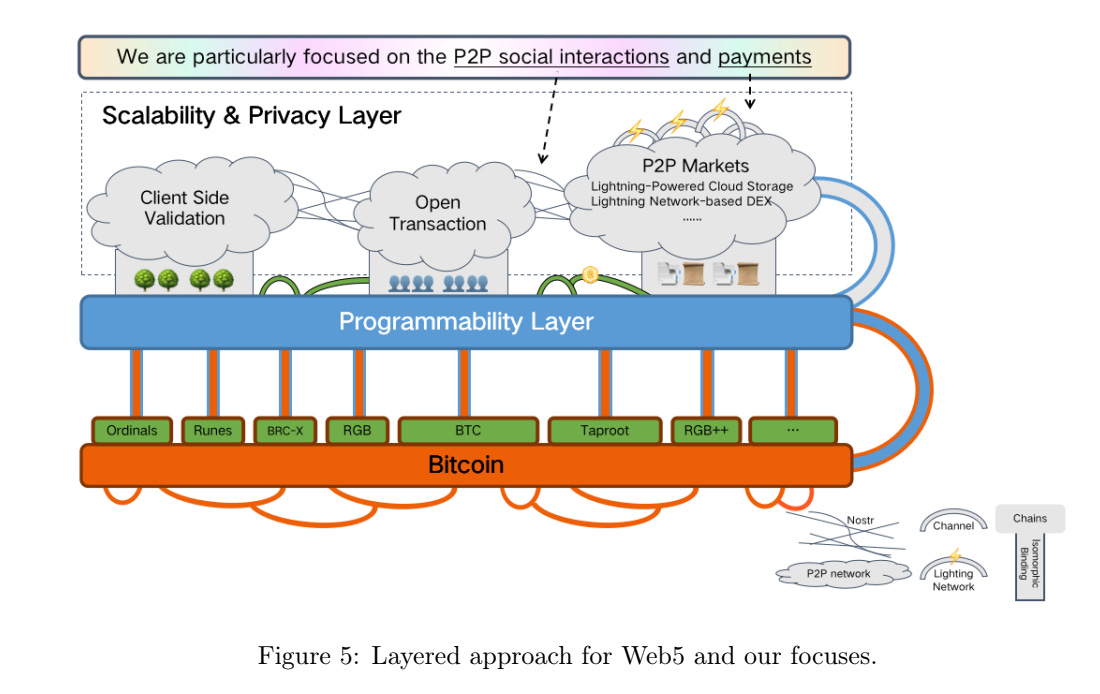

Regarding the implementation of Web5, Jan Xie, the Chief Architect of Nervos, provides a layered approach [40] built upon the unique combination of Bitcoin’s core features and the innovative technologies developed within the CKB ecosystem. As Fig. 5 shows, the foundation of this stack is the Bitcoin base layer, which serves as the most secure and reliable platform for asset issuance. However, Bitcoin’s limited programmability means that users cannot fully utilize these assets beyond simple ownership and transfer. To unlock the full potential of Bitcoin-based assets, we introduce a programmable layer on top of the base layer. This is where the RGB++ Layer comes into play, serving as a financial hub for assets issued on the Bitcoin chain. To ensure a secure and efficient connection between the base layer and the programmability layer, we employ the RGB++ protocol’s Isomorphic Binding for seamless cross-chain interoperability without needing trust-based bridges, eliminating a major point of failure in current cross-chain solutions.

Building upon this foundation, we can now construct additional layers focusing on scalability, privacy, and usability. One such solution is the use of client-side validation, which allows for the creation of a “forest of Merkle trees” that can process transactions and update state off-chain while still maintaining the security guarantees of the underlying blockchain. Other techniques, such as Open Transactions, Chaumian e-cash, and peer-to-peer markets, can further enhance the capabilities of the Web5 stack, enabling a wide range of use cases and applications. To tie all these components together and provide a seamless user experience, we introduce the channels. Channels act as a bridge between the various components of the Web5 stack, as well as a connection between Web2 and Web3 technologies, where the Lighting Network is one kind of channel.

Key areas where Web5 shines are P2P payments and social networks. With the CFN, a next-generation common Lighting Network, we can enable fast, secure, and low-cost P2P payments across different blockchains and assets. By integrating CKB with Nostr through RGB++, we can create a seamless and user-friendly experience for P2P social interactions and micropayments [41]. We believe that these areas will create numerous opportunities.

4.4 Use Case

To achieve Web5, we have established the RGB++ Layer and stablecoins. CFN and Common Lightning Initiative are the last pieces that bring these elements together. Moreover, we witness the growth of Seal, the first RGB++ asset and its community drives the adoption and growth of this trinity. Let us use 3 user cases to illustrate:

P2P Economy - Decentralized Cloud Storage with Lightning-Powered Incentives. In this business model, users who require storage services can enter into smart contracts with storage providers on the RGB++ Layer, agreeing to pay for storage capacity and bandwidth on a pay-per- use basis. The platform utilizes CFN to facilitate fast, low-cost payments between users and storage providers, with payments automatically triggered based on actual usage metrics. Storage providers, in turn, are incentivized to offer reliable, high-quality storage services, as they are compensated directly by users through the Lightning Network. This creates a virtuous cycle of supply and demand, with users benefiting from low-cost, secure storage solutions, and providers earning income for their contributions to the network. To ensure data privacy and security, the platform leverages advanced encryption and sharding techniques through the RGB++ Layer, distributing data across multiple nodes to prevent unauthorized access or data loss. Users retain full control over their data, with the ability to grant or revoke access permissions as needed. This decentralized cloud storage platform addresses the limitations of traditional P2P file-sharing networks, such as lack of incentives, free riding, and the dilemma between poor performance and centralized platform controls [42], [43], by leveraging the power of the Lightning Network and smart contracts to reclaim a robust, self-sustaining P2P economy system.

BTCFi - Capturing Market Opportunities with “UTXO Lego”. Imagine a scenario where a user sees a significant market opportunity as the price of Seal is skyrocketing on the Bitcoin network. To capitalize on this, the user wants to leverage their ccBTC (pegged 1:1 to BTC and issued on CKB) as collateral to borrow stablecoins RUSD and immediately purchase Seal. Security is of the essence, so the centralized cross-chain bridge is unacceptable for the user. And executing this transaction within a single block is also innovative. This entire sequence is made possible by what we call “UTXO Lego”6. In this context, UTXO Lego refers to the modular and programmable nature of UTXOs, which allows for the creating of complex, automated transactions across different blockchains. Based on UTXO, we can securely link actions across the CKB and Bitcoin networks, ensuring that collateral locking, stablecoin borrowing, and Seal purchasing occur atomically: either all actions succeed or none do. This programmability is a distinctive feature of UTXOs, enabling more granular control over transaction execution compared to the account-based model used in Ethereum. Moreover, the security is further guaranteed by RGB++, that the user does not need the bridge to cross-chain the assets. Last, the UTXO model often results in lower transaction costs due to its more efficient handling of transaction data in a parallel way, particularly when interacting with multiple blockchains. This approach demonstrates how BTCFi can offer a more robust, secure, and cost-effective alternative to current DeFi solutions.

PayFi - Lightning Network-based DEX for Seamless P2P Payments. One of the most promising applications enabled by the convergence of the Bitcoin Lightning Network and CKB’s CFN is creating a Lightning Network-based DEX for BTC, stablecoins, and RGB++ assets. By leveraging the ability of CFN to facilitate trustless, cross-Lightning Network atomic swaps, users can easily exchange BTC for stablecoins such as USDT or RUSD within the CKB ecosystem without the need for centralized exchanges or KYC procedures. In essence, this Lightning Network-based DEX can be seen as a decentralized, P2P alternative to traditional financial networks like VISA, where nodes play the role of “branch” and get rewards from the liquidity they staked. This DEX empowers users to engage in fast, secure, and private P2P transactions (rather than interact with smart contracts), enabling them to seamlessly convert between the stability of stablecoins and the digital gold standard of BTC. The atomic swap mechanism ensures that both parties receive their respective assets simultaneously, eliminating counterparty risk and enhancing the overall security and reliability of the platform. Moreover, CFN’s multi-asset capabilities open up exciting possibilities for instant, zero-fee trading of RGB++ assets within Lightning channels. For example, users can create markets for trading RGB++ NFTs (DOBs) or RGB++ coins, with CKB serving as the base currency for pricing and settlement. These markets enable real-time, frictionless trading experiences, empowering creators, collectors, and traders to exchange value directly without the burden of high transaction fees or lengthy confirmation times.

5. Conclusion

The blockchain industry stands at a crossroads. Down one path lies the continuation of the Ethereum model, a path marked by centralization, rent-seeking, and a betrayal of the core principles of decentralization. Down the other lies a return to the original vision of Bitcoin, a peer-to-peer system that empowers individuals and enables true decentralization.

The choice is clear. We must embrace the Bitcoin Renaissance and the innovations it brings. Among these are the RGB++ Layer, CKB Fiber Network, and native stablecoins. We must work to create a more equitable and sustainable model for value creation and distribution, moving away from the token-centric model of the past and towards a service-oriented future. This future is a Web5 future, which combines the good parts of Web2 and Web3.

The road ahead will be challenging, but the rewards will be immense. So let us unite as a community, united in our commitment to the Bitcoin P2P vision. Let us build, innovate, and create with the passion and vision of the early pioneers. And let us show the world the true power and potential of a P2P future.

The choice is ours. The future is in our hands. Let us start.

References

[1] S. Nakamoto, “Bitcoin: A peer-to-peer electronic cash system,” 2008.

[2] A. Oram, Peer-to-peer: harnessing the benefits of a disruptive technology. " O’Reilly Media, Inc.", 2001.

[3] S. Barile, C. Simone, and M. Calabrese, “The economies (and diseconomies) of distributed technologies: The increasing tension among hierarchy and p2p,” Kybernetes, vol. 46, no. 5, pp. 767–785, 2017.

[4] C. Rossignoli, C. Frigerio, and L. Mola, “Le implicazioni organizzative di una intranet adot- tata come tecnologia di coordinamento,” Sinergie Italian Journal of Management, no. 61-62, pp. 351–369, 2011.

[5] R. Peeters, The algorithmic society: technology, power, and knowledge. Routledge, 2020.

[6] P. Baran, “On distributed communications networks,” IEEE transactions on Communications Systems, vol. 12, no. 1, pp. 1–9, 1964.

[7] Bitstamp. “What was the blocksize war?” (2023), [Online]. Available: https://www.bitstamp. net/learn/crypto-101/what-was-the-blocksize-war/.

[8] R. Zhang and B. Preneel, “Lay down the common metrics: Evaluating proof-of-work consensus protocols’ security,” in 2019 IEEE Symposium on Security and Privacy (SP), IEEE, 2019, pp. 175–192.

[9] H. Chen, H. Duan, M. Abdallah, et al., “Web3 metaverse: State-of-the-art and vision,” ACM Transactions on Multimedia Computing, Communications and Applications, vol. 20, no. 4, pp. 1–42, 2023.

[10] V. Buterin. “The limits to blockchain scalability.” (2021), [Online]. Available: https : / / vitalik.eth.limo/general/2021/05/23/scaling.html.

[11] R. Espejo, “Cybernetics of governance: The cybersyn project 1971–1973,” Social systems and design, pp. 71–90, 2014.

[12] Y. Zhang. “Comparison between the utxo and account model.” (2018), [Online]. Available: https://medium.com/nervosnetwork/my-comparison-between-the-utxo-and-account- model-821eb46691b2.

[13] J. Coghlan. “Ethereum dev’s paid eigenlayer role sparks debate on ‘conflicted incentives’.” (2024), [Online]. Available: https ://cointelegraph . com / news / ethereum - researcher - eigenlayer-role-conflict-debate.

[14] G. Wood et al., “Ethereum: A secure decentralised generalised transaction ledger,” Ethereum project yellow paper, vol. 151, no. 2014, pp. 1–32, 2014.

[15] L2beat. “Upgradeability of ethereum l2s.” (2024), [Online]. Available: https://l2beat.com/ multisig-report.

[16] U. W. Chohan, Initial coin oflerings (ICOs): Risks, regulation, and accountability. Springer, 2019.

[17] A. Walch, “Deconstructing’decentralization’: Exploring the core claim of crypto systems,” 2019.

[18] P. Baehr, “The image of the veil in social theory,” Theory and Society, vol. 48, pp. 535–558, 2019.

[19] BitcoinMagazine. “What is an ico?” (2017), [Online]. Available: https://bitcoinmagazine. com/guides/what-is-an-ico.

[20] D. W. Arner, R. Auer, and J. Frost, “Stablecoins: Risks, potential and regulation,” 2020.

[21] P. Howitt, “Beyond search: Fiat money in organized exchange,” International Economic Review, vol. 46, no. 2, pp. 405–429, 2005.

[22] P. Sztorc. “Nothing is cheaper than proof of work.” (2015), [Online]. Available: https://www. truthcoin.info/blog/pow-cheapest/.

[23] C. Acedo-Carmona and A. Gomila, “Personal trust increases cooperation beyond general trust,” PloS one, vol. 9, no. 8, e105559, 2014.

[24] T. A. Han, L. M. Pereira, and T. Lenaerts, “Evolution of commitment and level of participation in public goods games,” Autonomous Agents and Multi-Agent Systems, vol. 31, no. 3, pp. 561–583, 2017.

[25] J. Xie. “First-class asset.” (2018), [Online]. Available: https://medium.com/nervosnetwork/ first-class-asset-ff4feaf370c4.

[26] Cipher. “Rgb++ protocol light paper.” (2024), [Online]. Available: https://github.com/ ckb-cell/RGBPlusPlus-design/blob/main/docs/light-paper-en.md.

[27] UTXOStack. “Rgb++ layer: Pioneering a new era for the bitcoin ecosystem.” (2024), [Online]. Available: https://medium.com/@utxostack/rgb- layer- pioneering- a- new- era- for- the-bitcoin-ecosystem-65e48fb5ea9e.

[28] J. Poon and T. Dryja, The bitcoin lightning network: Scalable ofl-chain instant payments, 2016.

[29] J. Robert, S. Kubler, and S. Ghatpande, “Enhanced lightning network (off-chain)-based micropayment in iot ecosystems,” Future Generation Computer Systems, vol. 112, pp. 283–296, 2020.

[30] T. Brignall, “The new panopticon: The internet viewed as a structure of social control,” Theory & Science, vol. 3, no. 1, pp. 1527–1558, 2002.

[31] E. Silfversten, M. Favaro, L. Slapakova, S. Ishikawa, J. Liu, and A. Salas, Exploring the use of Zcash cryptocurrency for illicit or criminal purposes. RAND Santa Monica, CA, USA, 2020.

[32] K. Stewart, S. Gunashekar, and C. Manville, Digital Currency: Transacting and Value Exchange in the Digital Age. Rand Corporation, 2017.

[33] J. Baron, A. O’Mahony, D. Manheim, and C. Dion-Schwarz, “National security implications of virtual currency,” Rand Corporation, 2015.

[34] J. M. Carroll and V. Bellotti, “Creating value together: The emerging design space of peer-to-peer currency and exchange,” in Proceedings of the 18th ACM Conference on Computer Supported Cooperative Work & Social Computing, 2015, pp. 1500–1510.

[35] P. Dalziel, “On the evolution of money and its implications for price stability,” Journal of Economic Surveys, vol. 14, no. 4, pp. 373–393, 2000.

[36] UTXOStack. “P2p economy: Leading a blockchain renaissance.” (2024), [Online]. Available: https://medium.com/@utxostack/p2p-economy-leading-a-blockchain-renaissance-d4b091bf2c44.

[37] N. Szabo. “Money, blockchains, and social scalability.” (2017), [Online]. Available: https:// unenumerated.blogspot.com/2017/02/money- blockchains- and- social- scalability. html.

[38] E. Raymond, “The cathedral and the bazaar,” Knowledge, Technology & Policy, vol. 12, no. 3, pp. 23–49, 1999.

[39] M. Abiodun. “Jack Dorsey’s concept of web5: How does it evolve from web3?” (2023), [Online]. Available: https://www.cryptopolitan.com/jack-dorseys-concept-of - web5-how-does-it-evolve-from-web3/.

[40] J. Xie. “Bitcoin renaissance: Why and how?” (2024), [Online]. Available: https://substack.com/@ckbecofund/p-145544407.

[41] R. Su. “Nostr binding protocol.” (2024), [Online]. Available: https://github.com/RetricSu/nostr-binding/blob/main/docs/lightpaper.md.

[42] D. Guo, Y.-K. Kwok, X. Jin, and J. Deng, “A performance study of incentive schemes in peer-to-peer file-sharing systems,” The Journal of Supercomputing, vol. 72, pp. 1152–1178, 2016.

[43] L. Ramaswamy and L. Liu, “Free riding: A new challenge to peer-to-peer file sharing systems,” in 36th Annual Hawaii International Conference on System Sciences, 2003. Proceedings of the IEEE, 2003, 10–pp.

Follow CKB Updates: https://x.com/CKBEcoFund

Join CKB Community: https://t.me/ckb_community